Form is a tax form that is used to report income that you received, and which you need to report on your tax return. The payer sends the proper to the. Find And Download Federal Income Tax Forms, Schedules, And Tables. Let Select The Right Form Or Forms For You To Prepare And E-file. The EZ form (aka the EZ form) is the simplest and shortest form you can use to file your federal income taxes. Each year over 20 million.

| Author: | Goltijin Dozil |

| Country: | French Guiana |

| Language: | English (Spanish) |

| Genre: | Finance |

| Published (Last): | 1 January 2025 |

| Pages: | 26 |

| PDF File Size: | 7.20 Mb |

| ePub File Size: | 4.5 Mb |

| ISBN: | 492-5-64536-970-3 |

| Downloads: | 53522 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Fenridal |

You cannot just prepare and e-file state tax returns - learn more on how you can just prepare one or more State Tax Returns via efile. If you received any of these types of income, these forms will be sent to you by the end of January.

Your refund or balance due is the calculated by comparing the amount of tax you’ve already paid vs. Log into your efile. See the “Help” box on the upper right of the screen for more information about each entry.

Get Tax Return Support. Let’s just say that’s the amount of tax that you already paid, now earned income credit, so this starts to kick in if you make a fairly low income or if you have a lot of dependents and you still have a reasonably low income but for this individual, it’s not going to kick in, we’ll do future videos on that, so we’ll leave that blank, nontaxable combat pay election, we’ll assume that that doesn’t apply, add lines seven and eight A, these are your total payments and credits so this is essentially how much have I paid in total in taxes so far, 6, and 50 cents.

If you’re eligible for the earned income creditit will increase your refund. Home How efile Works About efile. For more information about the timing of Tax Year filed inread this article. So I’m single so I’m gonna put 10, over here.

So up here, there’s just your basic information, so let’s see, and I’m just gonna assume that I’m filling this out as a single individual but you could also fill it out as married. What Are the Different Kinds of ?

Foreign Address and Third Party Designee - enter address, designee. You come across a Form You make it easy to 11099ez my taxes!

Your guide to key tax terms - by Better Money Habits. When you prepare your tax return, you will need to report all of the taxable income you have received during the tax year. Income Tax Return for U. Taxes You Paid Each of the forms you receive will report the taxes you’ve already paid, or had withheld. Mailing addresses are on the forms or you can find them here.

If you have income reported on aefile. Additional Income and Adjustments to Income - enter during the efile. This is your taxable income, so this is interesting.

There are many different kinds of As noted earlier, the EZ covers the most common types of income - wages, salaries, and tips from your employer reported on 109e9z W-2interest income from banks and other financial institutions reported on Form INTand unemployment income reported on Form G. Since you can’t claim dependents with the EZ, there is no place to record their information.

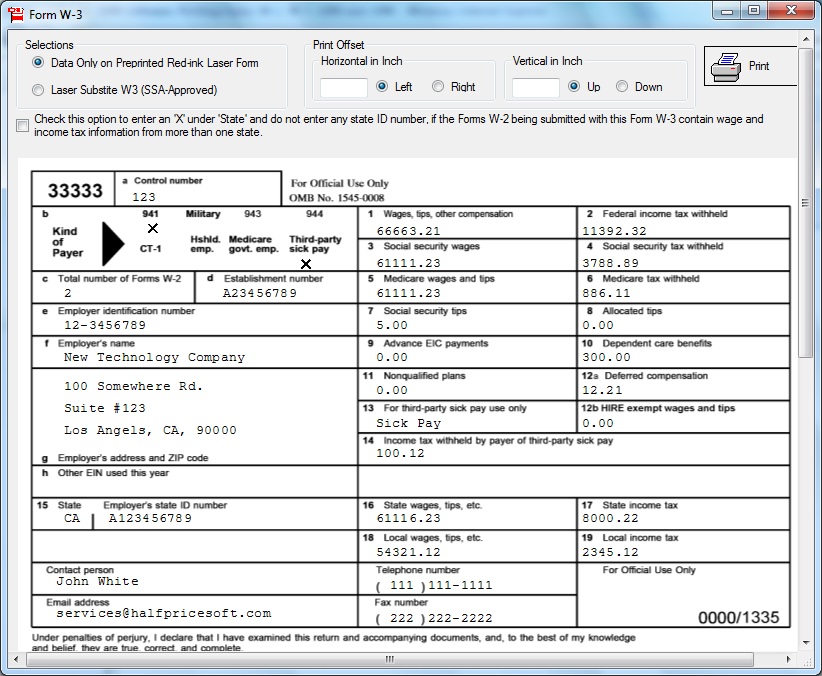

How To Prepare, efile Form with Your Income Tax Return

Automatic Extension of Time to File U. Each is designated by one or more letters such as K or MISCand each one is used to report different types of income. So federal income tax withheld from flrm W-2s, so once again, this is something that you go to your W-2 that you got from your employer and the and it’ll say how much federal tax was withheld so you take the total amount that was withheld from the W-2s and s and you put it here.

So we have another video on the W-2 form, this will come from your employer if you have one employer, if you had multiple employers in the previous year, then you will have multiple W-2s and the W-2 should go in the beginning, you should get it at the end or you should get it at the beginning of the new year so if we’re filing taxes forwe should fogm filling out this form some time in earlyafter we got our W-2 and you usually get your W-2 in January of the new year, so January, probably January of Research shows it takes over 3 and half hours on average to do it by hand.

eFile 2018 Tax Year Forms in 2019

Pencil and paper The old school way to do your taxes is with pencil and paper. Where Is My Refund? Biggest Refund Guarantee Details.

We believe Common Form is the best option for EZ filers and hope you’ll give us the chance to earn your business. And then you sign to kind foorm say that, hey, this is all real, under penalties of perjury, which you don’t wanna, you don’t wanna find out what they are, I declare that I have examined this return to the best of my knowledge and belief, it is true, correct, and accurately lists all amounts and sources of income I received during the tax year.

They handle just about any tax situation you can think of. Citizens and Resident Aliens Abroad.