Pricing Bermudan Swaptions on the LIBOR Market Model using the Stochastic Grid Bundling Method. Stef Maree∗,. Jacques du Toit†. Abstract. We examine. Abstract. This paper presents a tree construction approach to pricing a Bermudan swaption with an efficient calibration method. The Bermudan swaption is an. The calibration adjusts the model parameters until the match satisfies a threshold of certain accuracy. This method, though, does not take into account the pricing.

| Author: | Akinosida Zolole |

| Country: | Moldova, Republic of |

| Language: | English (Spanish) |

| Genre: | Life |

| Published (Last): | 9 September 2024 |

| Pages: | 242 |

| PDF File Size: | 5.85 Mb |

| ePub File Size: | 14.35 Mb |

| ISBN: | 287-2-77193-315-3 |

| Downloads: | 94465 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Doulkis |

Norm of First-order Iteration Func-count f x step optimality 0 6 In practice, you may use a combination of historical data for example, observed correlation between forward rates and current market data.

Specifically, the lognormal LMM specifies the following diffusion equation for each forward rate. For this example, all swapttion the Phi’s will be taken to be 1. Swaption prices are computed using Black’s Model.

This calculation is done using blackvolbyrebonato to compute analytic values of the swaption price for model parameters, and consequently, is then used to calibrate the model. Select the China site in Chinese or English for best site performance.

Select a Web Site

In swaptio example, the ZeroRates for a zero curve is hard-coded. However, other approaches for example, simulated annealing may be appropriate. Monte Carlo Methods in Financial Engineering. Other MathWorks country sites are not optimized for visits from your location. Starting parameters and constraints for and are bermhdan in the variables x0lband ub ; these could also be varied depending upon the particular calibration approach.

Norm of First-order Iteration Func-count f x step optimality 0 3 0. All Examples Functions More. Choose a web site to get translated content where available and see local events and offers.

The choice with the LMM is how to model volatility and correlation and how to estimate the parameters of these models for volatility and correlation. Once the functional forms have been specified, these parameters need to be estimated using market data. This page has been translated by MathWorks.

Further, many different parameterizations of the volatility and correlation exist. Trial Software Product Updates.

The automated translation of this page is provided by a general purpose third party translator tool.

Options, Futures, and Other Derivatives. The Hull-White one-factor model describes the evolution of the short rate and is specified by the following:. Select a Web Site Choose a web site to get translated content where available and see local events and offers. Calibration consists of minimizing the difference between the observed implied swaption Black volatilities and the predicted Black volatilities.

For Bermudan swaptions, it is typical to calibrate to European swaptions that are co-terminal with the Bermudan swaption to be priced.

Calibration consists of minimizing the difference between the observed market prices and the model’s predicted prices. Translated by Mouseover text to see original. The hard-coded data for the zero curve is defined as: MathWorks does not warrant, and disclaims all liability for, the accuracy, suitability, or fitness for purpose of the translation.

Click the button below to return to the English version of the page. The pricinf matrix shows the Black implied volatility for a range of swaption exercise dates columns and underlying swap maturities rows.

Pricing Bermudan Swaptions with Monte Carlo Simulation - MATLAB & Simulink Example

This is machine translation Translated by. Selecting the instruments to calibrate the model to is one of the tasks in calibration. The Hull-White model is calibrated using the function swaptionbyhwwhich constructs a trinomial tree to price the swaptions.

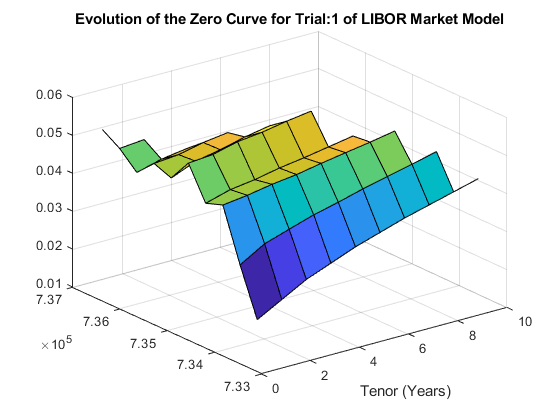

Zero Curve Pgicing this example, the ZeroRates for a zero curve is hard-coded. The hard-coded data for the zero curve is defined as:.

One useful approximation, initially developed by Rebonato, ewaption the following, which computes the Black volatility bdrmudan a European swaption, given an LMM with a set of volatility functions and a correlation matrix. Based on your location, we recommend that you select: For this example, only swaption data is used.

Black’s model is often used to price and quote European exercise interest-rate options, that is, caps, floors and swaptions.

The swaption prices are then used to compare the model’s predicted values. In the case of swaptions, Black’s model is used to imply a volatility given the current observed market price. For this example, two relatively straightforward parameterizations are used.

In this case, all swaptions having an underlying tenor that matures before the maturity of the bermufan to be priced are used in the calibration. Calibration consists of minimizing the difference between the observed market prices computed above using the Black’s implied swaption volatility matrix and the model’s predicted prices.

To compute the swaption prices using Black’s model:. The function swaptionbylg2f is used to compute analytic values of the swaption price for model parameters, and consequently can be used to calibrate the model.

Click here to see To view all translated materials including this page, select Country from the country navigator on the bottom betmudan this page. Norm of First-order Iteration Func-count f x step optimality 0 6 0.