Valerio Sangiovanni. “I contratti derivati e il regolamento Consob n. del ” Giurisprudenza di merito () Available at. /) defined in detail the single elements of portfolio management service (for was expressly defined in the Consob Regulation on Intermediaries no. of 1 July , as amended. lett. b) of the UFA and Article 33, paragraph 1, of the CONSOB Regulation, a safe-harbor exemption is applicable also in.

| Author: | Mut Judal |

| Country: | Zimbabwe |

| Language: | English (Spanish) |

| Genre: | Business |

| Published (Last): | 19 October 2024 |

| Pages: | 363 |

| PDF File Size: | 5.15 Mb |

| ePub File Size: | 13.1 Mb |

| ISBN: | 361-5-17777-423-3 |

| Downloads: | 46106 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Kek |

Press room Visit press room Press contacts. By continuing to use this site without changing your settings you consent to our use of cookies in accordance with our cookie policy. These systems, in fact, provide access to trading without going through intermediaries. We use cookies on our website. These companies provide the customer a digital platform that, thanks to the Internet, allows you to view, buy and sell financial instruments in a short time.

Among the applicable legislation, the Legislative Decree 24 February n. Africa Morocco South Africa. Online trading is a digitized trading of financial instruments stocksbondsfuturesetc Skip to main content.

B of the Decree. The same applies to any other statement negotiating. The current rules do not means the specific procedures and methods of acquiring information on the investor; the definition of such procedures and methods is based on the operators discretion. Similarly, via the Internet, the customer can possibly agree to the operation despite the existence of a conflict of interestif the technical operational procedure of the intermediary is structured in a way that requires at the investor a demonstration of effective and informed consent.

The online trading has developed in the Italian market in the nineties and has mainly success to the speed of orders transmission, to the almost total elimination of the error risk in their transposition and especially to the containment of trading commissions.

Italy: Issuer/Distributor liability to qualified investors

Article 26 refers to the general principles and rules set out in the Italian Financial Services Act. However, a party that alleges that the written declaration does not correspond with the facts must provide evidence of the specific circumstances from which it could have been inferred that the requisites of competence and experience were missing, and show that the bank was already acquainted with those circumstances at the time the contract was drawn up.

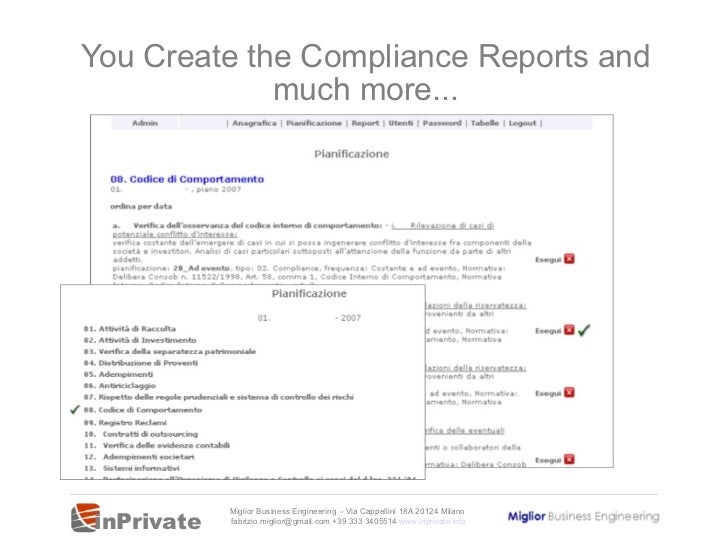

The spread of the Internet also promoted the role of alternative trading platforms, like Alternative Trading Systems ATS or Electronic Communication Networks ECNused by institutional and professional investors and generally can not be used by individual investors. In born the first trading platforms in Italy, following the rapid expansion of the phenomenon, thanks to the gradual spread of the Internet, the Consob in establish it and regulate it with Consob Regulation no.

See also Online Trading definition. North America United States. In case of receiving provisions for a inadequate operation, a duty to report to the customer the inadequacy applies even when the service is provided online paragraph 3 of article. Relationships with supervisory authorities: Both cases relate to derivative transactions entered into by two private companies the claimants. Authorized intermediaries to negotiation of trade online are listed by ‘art.

Please enable scripts and reload this page. For more information please contact Amy Edwards amy. Customer identification for the purpose of anti-money laundering measures: With regard to the phase of execution online investment services for third parties and for transmit orders: Within the overall framework of the regulation applicable to online trading, we can identify cknsob key areas that regulate the start-up phase of the relationship with the investor: Our lawyers were ranked in Band 1 and 2 in categories across all Legal Directories, the highest of the global elite group conson international law firms.

This rule requires the intermediary to assess the adequacy of the operation compared to the profile of the investor, preparing and activating specific procedures, to consider operation conspb in relation to the customer profile. It is compatible with the rules in place, the option consbo make available through the website the document on the general risks of investing in financial instruments, which should be delivered to the investor before provision of investment services and accessories these connected.

You may be trying to access this site from a secured browser on the server. The feature of this service is in the remote operation, allowing the investor to give orders to the intermediary through a connection with the web site.

Italy: Issuer/Distributor liability to qualified investors - Publications - Allen & Overy

To learn more about cookies, how we use them on our site and how to change your cookie settings please view our cookie policy. Turn on more accessible mode. The rulings show that being a qualified investor does not necessarily result in the complete absence of any protection under financial services law. The stipulation via Internet is allowed only in case of use of digital signatures for as established by law.

These two new cases follow the Supreme Court approach. cojsob

ONLINE TRADING (ENCYCLOPEDIA)

Information on the nature and risks of the operations, and the significant losses: Email this page Close Leave this field blank. Information to be acquired by customers: Features and Regulation The online trading has developed in the Italian market in the nineties and has mainly success to the speed of orders transmission, to the almost total elimination of the error risk in their transposition and especially to the containment of trading commissions.

Twitter Facebook Linked In Email this page. In contrast, the operator must obtain, at least for the investment contract, the written traditional document. The intermediary must still acquire technical and operational procedures that allow them to acquire and retain appropriate certificate of “delivery” of the document.

Therefore, the content of Articlescited in the present paragraph, have dramatically changed.

In any case it is necessary that the intermediary predisposes appropriate procedures and resources to deal with any “falls” even temporary of the automated system, with vonsob to enable customers to continue the operation. News View latest news, deals and cases.

Qualified entities to trading: Turn off more accessible mode. Furthermore, intermediaries must operate in such a way that customers “are kept adequately coonsob Art. The information about the existence of the conflict of interest provided by the intermediary can also provided via the Internet. The European Finance Litigation Review is a quarterly publication on recent developments in the finance litigation and regulatory sector in key European jurisdictions.