Fill Dd Form 1, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller ✓ Instantly ✓ No software. Try Now!. Fill Dd Form , download blank or editable online. Sign, fax and dd form Preview of sample n t cclass 11 det of birth 1 13 c r a l n DD State of Legal PDF document icon DD State of Legal — PDF document, 15 KB ( bytes). News. Winter .

| Author: | Sar Zolozil |

| Country: | Mayotte |

| Language: | English (Spanish) |

| Genre: | Finance |

| Published (Last): | 7 October 2024 |

| Pages: | 256 |

| PDF File Size: | 14.53 Mb |

| ePub File Size: | 18.5 Mb |

| ISBN: | 968-7-39841-140-5 |

| Downloads: | 41660 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Faunris |

Changing your legal residence or HOR. Has anyone done this?

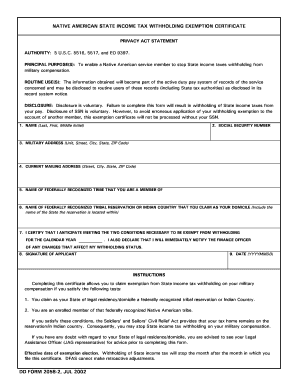

DD 2058 State of Legal Residence.pdf

What is involved with it? I know it’s not just a simple change with a lot of things to consider. I’m just tired of giving money away to the state of Taxachusetts. I haven’t lived in that state for 12 years and I’m 208-1 of their shenanigans.

This is mainly because a lot of people go across the border to New Hampshire to buy stuff because they don’t have sales tax. Really rustles my jimmies. I did it when I inprocessed my base Are you talking about changing your state of legal residence for tax purposes or changing your home of record?

Those are two completely different things. If you want to change your state of legal residence for tax purposes all you need to do is fill it a DD It really is that simple. Finance is not the State of legal residence police. If you want it changed we change it. If you read the form it explains that the only thing necessary to change your state of legal residence is prescense in that state and intent to return after you seperate from the military.

Here is what the form says: The terms “legal residence” and “domicile” are essentially interchangeable. In brief, they are used to denote that place where you have your permanent home and to which, whenever you are absent, you have the intention of returning. Your “home of record” is used for fixing travel and transportation allowances. A “home of record” must be changed if it was erroneously or fraudulently recorded initially.

Enlisted members may change their “home of record” at the time they sign a new enlistment contract. Officers may not change their “home of record” except to correct an error, or after a break in service. In most cases, you must actually reside in the new State at the time you form the intent to make it your permanent home.

Such intent must be clearly indicated. Your intent to make the new State your permanent home may be indicated by certain actions such as: If you want you can fill out the DD electronically and digitally sign it.

Then email it to finance. I t really is as simple as one person said above. Depending onw hat state you elect you also have one other step to complete. Once you state of legal residence is chanegd you need to login to MyPay and declare taht you want to be exempt from state income tax. Being exempt is not necissarily automatic unless the state you elect does not have an income tax.

It’s going to vary a little based on the state you want to now claim. There was a laundry list of things on the states. But the most important for me was changing my LES.

If you really are in Germany as your location says it could be tricky. Do they give you any grief about living there when you get out etc?

Form Dd2058

Remember, once you get out you are a resident of whatever state you live in. No paperwork to fill out, etc. So there would be no point for any state to give you grief about living there afterwards. That is an interesting question.

DD State of Legal — Army ROTC “Cardinal Battalion”

They don’t care where you go when you get out BUT if you separate or are discharged, they will only pay to move your junk up to the estimated cost to move it to your HOR. You can still move further away, they just won’t pay. If you retire, you get a free move to wherever the hell you want to go The only issue you might have is getting any or all of your state taxes back from MA.

Since we are already in April you have paid at least 3 months worth of taxes to MA. Your money has already been sent to MA. If you want it back you have to deal with the state.

They may ask you what date you decided that you intended not to return. They may want some sort of verification of that. For example they may wantt o know when you registered to vote in the new state or when you licensed you car in the new state. They may also simply accept the DD as prrof. Either way worse case scenario they keep your first 3 months of taxes and you are tax free for the rest of the year.

For what it is worth I always noticed that most people in the AF are “residents” of three states. Texas, Alaska, and Florida. Texas and Florida have no income tax and Alaska is also not an income states and has the added bonus of paying residents for allowing oil companies to pillage the state there are extra requirements to get that bonus though.

I changed it one month into the year All I did was file taxes with the original state as a part year resident because your W-2 will reflect that you were a resident there at least part of the time since you did pay some taxes to the state.

Your taxable income for the state you are leaving will only be for those months that you were considered a resident. Yep, formerly a Virginian switched to FL with the quickness when I got here Thanks for all the input. I’m not going to change my HOR but I am seriously considering changing my legal residence. I hardly ever get anything back anyway. I have always thought it is absolutely ridiculous that States who have income taxes can still make military members who aren’t even living there pay.

Ds services are they providing you for those tax dollars?

I’m sure they love generous people like you. I agree with you on this.

I think their basic premise though is that they only require you to pay taxes if you plan on returning someday. It is based on the assumption that when you leave the military you plan to return from where you came from.

Sd guess some states think you should pay them to take care of things while you are gone. Sort of like a babysitting fee. Here in Ohio they also have a very interesting tax law. Most municipalties charge a city income tax on top of state tax military are exempt. 20058-1 interesting part is that Ohio law allows a city to collect tax from you if you work in for, city even if you do not live there. You are allowed to deduct any taxes paid to the city where you actually live but in the end forj can still collect the difference.

Kind of a strange law if you ask me. I understand the fact that if you work in the city you are using their roads and to a certain extent their police and fire. The only thing is that you are also supporting their school district and your child would not even be eligble to attend.