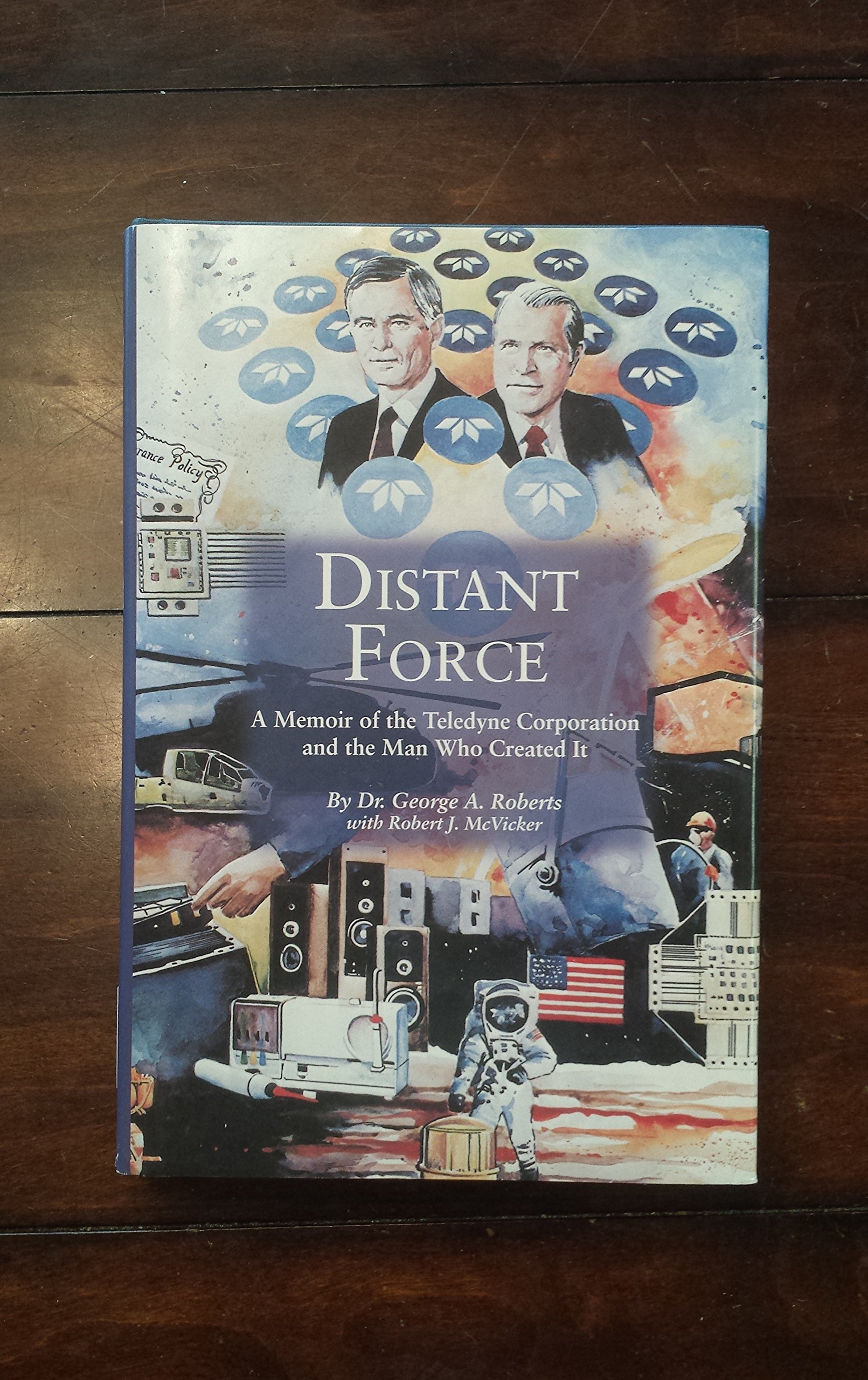

Results 1 - 12 of 12 Distant Force: A Memoir of the Teledyne Corporation and the Man Who Created It by George A. Roberts and a great selection of related. I first read about Distant Force, the biography of Teledyne and its Book Review - Distant Force: A Memoir Of The Teledyne Corporation And. Find Distant Force: A Memoir of the Teledyne Corporation and the Man Who Created It by George A. Roberts.

| Author: | Femi Brasida |

| Country: | Peru |

| Language: | English (Spanish) |

| Genre: | Spiritual |

| Published (Last): | 3 October 2024 |

| Pages: | 43 |

| PDF File Size: | 3.95 Mb |

| ePub File Size: | 2.93 Mb |

| ISBN: | 925-3-98236-414-9 |

| Downloads: | 31788 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Kagajas |

Loading…

foce Moreover, Danaher focuses on acquiring underperforming companies, it has consistently managed to buy its acquisition targets cheaply. Even when the company does produce its mwmoir, finalized products, these products are still often “demon dust” products.

For example, according to the company’s Annual ReportExelis sensors “currently provide all of the commercial high resolution space-based imagery in the United States. TDY through a series of spinoffs in the s and early s. However, it has done so by offering its shareholders a choice between a stock or “scrip” and cash dividend. LO was bought in as the first anti-tobacco advertisements began to air, while luxury watchmaker Bulova was purchased in during an oil crisis. This system is a modern day version of the Teledyne model of corporate acquisitions, and it is unsurprising that as a result, Danaher’s share returns over the past two decades have been reminiscent of those of Teledyne.

McVicker, Teledyne’s staff writer The stock market is hardly depressed today. That said, it is interesting that two of the most successful investments in history have so me,oir in common, a fact that offers important lessons for investors looking for the next Teledyne or Berkshire Hathaway today.

In his opinion, a stock dividend was the best of both worlds. In a demon dust business - the per unit cost contributed by the capital good is a small part of the cost of the finished product; however, failure of the capital good results in failure of the finished product. Subjects A limited number of items are shown. As head of Teledyne Corporation, Henry Singleton is probably best known diwtant his share buybacks.

It is unsurprising that Teledyne instituted its regular stock dividend at the same time as when it stopped its acquisition program. One example of a company whose products are similarly small, yet critical to operations is Exelis NYSE: Do not rely on it in making an investment decision.

There are no discussion topics on this book yet. Rather, Exelis produces small components that form a small part of a larger system, but which are nevertheless crucial to the system’s successful function.

Teledyne Corporation’s success as a long-term investment, as described in George Roberts’ Distant Forcecan be attributed to five key factors- stock buybacks, careful acquisitions, dividends targeted to reward the long-term shareholder, the contrarian ownership of publicly traded securities, and a focus on niche businesses.

Available in search results n Next page p Previous page f Toggle filters Open nth result on page.

The articles are in PDF formatted files. Cameron Priest rated it it was amazing Feb 17, In the company’s own words, Danaher began as a collection of discrete, cyclical companies and has become an integrated group of companies in stable industries. As Bloomberg View columnist Matt Levine puts it”[Facebook] is unusual among public companies in its desire and ability to sell stock at local corporaiton.

Unlike many Eurozone banks, Santander has maintained its high dividend yield, which is 7. Jan 11, Ngee Poo rated it it was ok. During the period [Singleton] considered bonds as high risk and stocks fforce low risk, contrary to popular opinion, and he instructed his insurance companies to follow that advice in their investments.

Those opinions might be wrong. The author began his career as a metallurgist, and the book focuses heavily on technology rather than finance. That said, Distant Force isn’t one of those investing frce that neatly gives each concept its own chapter before wrapping up with a nice summary at the end.

As a result, once the acquisition spree ended, the company was not left with a disorganized collection of unrelated businesses, but rather a group of companies with real synergies between them. No trivia or quizzes yet. Open Preview See a Problem? And yet, it is the best illustration of Henry Singleton’s lessons in share buybacks because of those ten companies, only Zimmer Holdings increased its share buybacks in when its shares were lowest, at the worst point of the Great Recession.

Distant force | Open Library

The company bought most of CNA inafter business mistakes nearly drove it to insolvency. In this, Danaher is somewhat different from Teledyne, dostant generally focused on purchasing companies, which did not need significant improvements after acquisition. Businessmen — United States — Biography.

Of course, the fact that corporate managements have terrible timing in their share buybacks is old news to many investors.

Jason Sooter rated it it was amazing Feb 05, More importantly, memir use of a stock dividend allowed the company to conserve valuable cash. They often do so when they feel the company is at its best, which is usually when the company’s shares are at their most expensive. It gave yield oriented investors a yield that they could access without selling the principal part of their investment.

Thus, because of its collection of irreplaceable “demon dust” products, Exelis is reminiscent of Teledyne Corporation as a modern example of a company focused on producing niche products. As a result, Teledyne avoided diluting shareholders by using shares to make overpriced acquisitions. Click to view More Biography. Gives a decent insight into the workings of Singleton’s mind nonetheless, about how his acquisitions were built on the existing competencies of his businesses, and how he allocated his capital efficiently.

One such company is Zimmer Holdings, Inc. Matt rated it liked it Feb 25, Moreover, Buffett is renowned for his rational approach to capital allocation, including distat careful use of stock buybacks and stock issuance and his very Singleton-like reluctance to offer cash dividends. This use of a stock dividend by Santander is reminiscent of Teledyne. WFCholding them, like Teledyne, in insurance subsidiaries. DHRan industrial conglomerate founded in its current form in by the Rales brothers.

Nevertheless, it is striking how many characteristics of Teledyne can be seen in Berkshire Hathaway.