Istisna sukuk are certificates that carry equal value and are issued with the aim of mobilizing the funds required for producing products that are owned by the. The same type of contract applies to sukuk. In a mudaraba sukuk, the sukuk holders are the silent partners, who don’t participate in the management of the. Istisna sukuk structures have been widely accepted for manufacturing and construction financing purposes. This paper looks at the structural development of.

| Author: | Tygoll Faer |

| Country: | Burma |

| Language: | English (Spanish) |

| Genre: | Technology |

| Published (Last): | 2 October 2024 |

| Pages: | 319 |

| PDF File Size: | 8.19 Mb |

| ePub File Size: | 5.44 Mb |

| ISBN: | 492-7-13416-385-4 |

| Downloads: | 61714 |

| Price: | Free* [*Free Regsitration Required] |

| Uploader: | Bagor |

Hanafi Position Cash Waqf: Issues Faced by Islamic Banks. Basic Features of Islamic Economics. Of particular significance is the prevailing view that sukuk al-istisna are not tradable during the construction period. The suitability of Istisna for financial intermediation is based on the permissibility for the contractor in Istisna to enter into a parallel Istisna contract with a subcontractor. In Law and jurisprudence, it refers to a contract by which istissna of the parties commits itself to manufacture and deliver a certain produce for the other party within a certain period of time and in exchange for a certain amount of money.

Securities against Murabahah Price. Islamic Economics and Economics. Rules of Leasing - Ijarah. This contains an undertaking to lease such that, following delivery of the Assets, Trustee leases the Assets to Originator in a manner that: Basic mistakes in Murabahah Financing. Supremacy of the Sharjah.

Negation of Excessive Pursuit of Wealth. Capitalist Accumulation or Globalization. Speculation, Uncertainty, Interest, and Unemployment. Remission of the Poor Debtor. It should, however, be noted that this approach to investment of the unutilised sukuk proceeds has received some criticism.

Impact on Host Societies. Size of Interest Receipts and Payments: Legislative Changes in Islamic Finance.

Sukuk al-Istisna -

Distinguishing Characteristics of an Islamic Economy. On the other hand, many entrepreneurs with knowledge, experience and potential do istjsna have the financial resources required for investment. The Origins of Waqf. Zakah and Ushr System: Musharakah - Distribution of Profit.

Malaysia International Islamic Financial Centre (MIFC) :

Permission of Cash Rent Sukukk. The SPV uses the rental payments to make payments to the sukuk holders. Discounting Under Uncertainty for a Private Investor.

Poverty and Economic Inequality: Distribution of Wealth in Islam. A Case of Pakistan. Behavior of the Producer. Basic Rules of Sale.

Istisna’ zukuk have three distinguishing features: Speculation and on Demand for Money in an Islamic Economy. The SPV holds the assets in trust for the sukuk holders who each own a proportionate interest in the assets in accordance with the value of their investment.

Some Reflections Government Expenditures on Interest: The Role of the Human Being.

Sukuk al-istisna’a

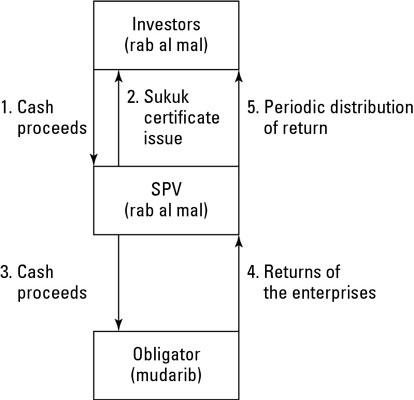

Historical Perspective Reference to the Ottoman Case. Also Found In Islamic Finance. In a sukuk al-istisna’a transaction:. Five Main Contracts in Islamic Finance. Share of the Poor in Zakah.

Risk Assumption by Employees. Constructing a Murabaha deal. Mechanism of Fiscal Policy. Islamic Principles of Finance.